Discipline-Building Habits That Improve Financial Stability

Building wealth is not only about earning a high income. It is about managing what you earn with intention, consistency, and discipline. For many Filipinos, especially Overseas Filipino Workers who sacrifice time away from their families, financial stability is not just a goal. It is a responsibility.

This is where Financial Discipline Habits become powerful. These habits shape how you save, spend, invest, and plan for the future. They protect you from debt traps. They give you peace of mind. Most importantly, they turn hard work into long term security.

In this guide, we will explore practical, realistic, and actionable discipline-building habits that improve financial stability. These are not complicated strategies. They are daily behaviors that compound over time.

Whether you are working abroad, managing finances at home, or planning your next financial move, this article will help you build stronger financial foundations.

Table of Contents

Understanding Financial Discipline Habits and Why They Matter

Before applying specific strategies, it is important to clearly understand what Financial Discipline Habits mean. These habits involve controlling spending, delaying gratification, focusing on long term goals, and making consistent responsible money decisions. Financial discipline is not about restriction. It is about intention and smart choices.

For Overseas Filipino Workers, financial discipline carries even greater importance. Working abroad often brings higher income, but it also increases responsibility and pressure. Without strong Financial Discipline Habits, hard earned money can disappear faster than expected.

Common challenges include:

- Income that is higher than local wages

- Heavy family financial expectations

- Frequent spending temptations

- Pressure to show visible success during vacations

These factors make discipline essential, not optional.

Without discipline, even a high salary may lead to debt and stress. With discipline, even a moderate income can build savings and long term stability. Financial education programs promoted by the Bangko Sentral ng Pilipinas emphasize that improving money management skills strengthens economic security. Knowledge combined with consistent action creates lasting financial stability.

Habit 1: Create a Clear Financial Vision

Define What Financial Stability Means to You

Financial stability does not look the same for everyone. For many OFWs, it represents security, dignity, and long term peace of mind. Without a defined vision, income can easily disappear without meaningful progress. Clear Financial Discipline Habits begin with knowing exactly what you are working toward.

For some OFWs, financial stability may include:

- Paying off family debt

- Building a home in the province

- Saving for children’s education

- Preparing for early retirement

These goals provide direction and purpose.

Take time to write down specific targets such as:

- One year financial goals

- Five year financial milestones

- Long term retirement plans

Clarity strengthens focus. When goals are visible and measurable, discipline becomes easier to maintain and financial decisions become more intentional.

Break Big Goals Into Monthly Targets

Large goals can feel intimidating at first. A house worth 1.5 million pesos may seem impossible. However, saving 20,000 pesos monthly feels practical and achievable. Breaking major goals into smaller monthly targets transforms overwhelming plans into manageable actions.

When goals are divided into monthly steps, you:

- Track progress clearly

- Maintain motivation consistently

- Reduce impulsive spending

Financial Discipline Habits grow stronger when progress is visible. Clear direction combined with steady action builds confidence and long term financial stability.

Habit 2: Track Every Peso You Spend

Awareness Creates Control

Many people believe they understand where their money goes each month. In reality, small daily expenses quietly consume a large portion of income. Coffee runs, online shopping, random transfers, and unused subscriptions slowly reduce savings without notice. Awareness is the foundation of Financial Discipline Habits.

Common unnoticed expenses include:

- Daily food deliveries

- Impulse online purchases

- Extra mobile subscriptions

- Small cash withdrawals

These may seem minor individually but become significant over time.

Start tracking consistently by recording:

- Daily expenses

- Weekly totals

- Monthly spending categories

You may use a notebook, spreadsheet, or budgeting application. The tool matters less than consistency. Regular tracking builds awareness and encourages better financial decisions.

Identify Spending Leaks

After one full month of tracking, review your records carefully. Look for patterns and unnecessary spending. Honest evaluation helps you correct habits before they grow into larger financial problems.

Ask yourself:

- Which expenses were unnecessary

- Which expenses added value

- Where can spending be reduced

This simple review often increases savings quickly.

For OFWs who send remittances, coordination with family members is equally important. Discuss how funds are allocated and identify areas for improvement. Financial Discipline Habits work best when everyone involved shares responsibility and transparency.

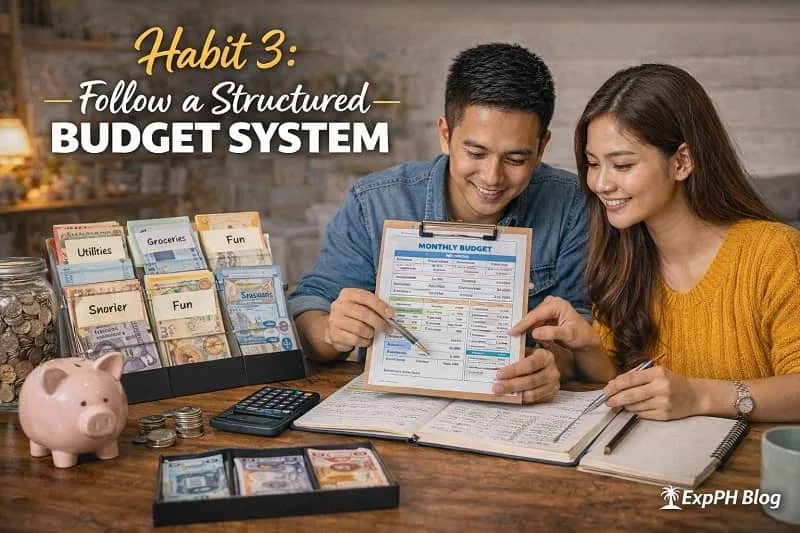

Habit 3: Follow a Structured Budget System

Use the 50 30 20 Framework as a Guide

A structured budget strengthens Financial Discipline Habits by giving every peso a clear purpose. Without structure, spending becomes emotional and inconsistent. A simple framework provides guidance and reduces confusion when allocating income each month.

The 50 30 20 model suggests:

- 50 percent for essential needs

- 30 percent for wants

- 20 percent for savings and investments

For OFWs, adjustments may be necessary. Many choose to increase savings to 30 or 40 percent to reach long term goals faster. The exact ratio may change, but structure must remain consistent.

When money has defined roles, decision making becomes easier. You are less likely to overspend because each category already has limits. Financial stability improves when spending follows a clear plan instead of daily impulses.

Automate Savings First

One of the strongest Financial Discipline Habits is paying yourself first. Instead of saving what remains after spending, reverse the order. Secure your future before funding lifestyle expenses.

When salary arrives, prioritize:

- Immediate savings transfer

- Investment allocation

- Emergency fund contribution

After these amounts are secured, the remaining balance becomes your spending allowance. This system prevents the common mistake of saving leftovers, which often results in no savings at all. Automation removes temptation and builds consistency over time.

Habit 4: Build and Protect an Emergency Fund

Why Emergency Funds Are Non Negotiable

Unexpected events can disrupt finances at any time. Job loss, medical emergencies, urgent travel, and family crises often arrive without warning. Without proper savings, these situations quickly create financial pressure and long term instability. Strong Financial Discipline Habits include preparing for uncertainty before it happens.

Without an emergency fund:

- You rely on loans

- High interest debt increases

- Financial stress grows

These outcomes weaken stability and delay long term goals.

Aim to build:

- Three to six months of expenses

- A separate emergency account

- A strict no leisure spending rule

This fund should only be used for real emergencies. Protecting it requires discipline and clear boundaries.

Keep It Accessible but Separate

An emergency fund must be available when needed, yet protected from daily spending temptations. Accessibility ensures quick response during urgent situations. Separation prevents accidental use for non essential expenses.

Your emergency savings should be:

- Liquid and secure

- Easy to withdraw

- Separate from daily accounts

This structure protects your reserve.

For OFWs, an emergency fund is even more critical. Contract termination, delayed salary, or unexpected repatriation can happen. Having dedicated savings ensures stability during transitions and reduces dependence on borrowing.

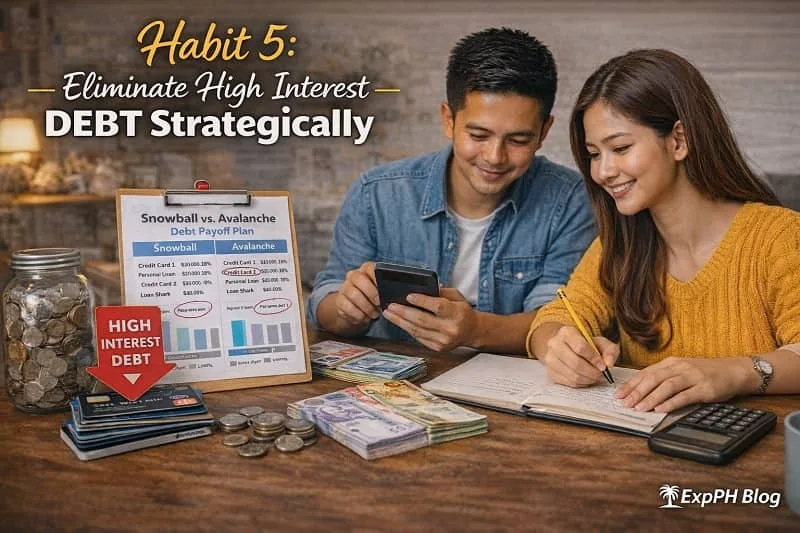

Habit 5: Eliminate High Interest Debt Strategically

Understand the True Cost of Debt

High interest debt weakens financial stability faster than most people realize. Credit cards and informal loans often carry rates that quietly consume income each month. Without control, debt payments reduce savings and delay long term goals. Strong Financial Discipline Habits require confronting debt honestly.

Warning signs include:

- Paying high interest monthly

- Making minimum payments only

- Managing several debts at once

When these patterns continue, most of your income goes toward interest instead of wealth building. This cycle creates stress and limits financial progress.

Recognizing the true cost of debt encourages decisive action. Every peso paid toward interest is money that could support savings, investments, or family security.

Apply the Snowball or Avalanche Method

Structured repayment strategies improve focus and motivation. Rather than paying randomly, choose a clear system and follow it consistently. Organized action strengthens Financial Discipline Habits and accelerates debt freedom.

Two effective methods include:

- Snowball method, pay smallest balance first

- Avalanche method, pay highest interest first

The snowball method builds confidence through quick wins. The avalanche method saves more money over time by reducing interest faster.

Select the approach that keeps you consistent. Discipline combined with a clear plan turns debt repayment into steady progress toward financial stability.

Habit 6: Invest in Skills That Increase Your Income

Discipline Is Not Only About Cutting Expenses

Financial Discipline Habits are not limited to reducing expenses. True financial growth happens when income increases while spending remains controlled. Focusing only on saving has limits. Expanding earning potential creates stronger and more sustainable financial stability over time.

Upskilling can help you:

- Qualify for promotions

- Transition to higher paying roles

- Start freelance services

- Build additional income streams

For OFWs, learning digital skills, language proficiency, or technical certifications can open international opportunities. Expanding competence strengthens bargaining power and career flexibility.

When income grows with discipline, savings and investments increase naturally. This balanced approach builds financial security faster than cost cutting alone.

Continuous Learning as a Financial Discipline Habit

Continuous learning is one of the most powerful Financial Discipline Habits. Allocating time and resources to skill development reflects long term thinking. Instead of spending on temporary wants, investing in education strengthens future earning capacity.

Online platforms such as Udemy provide practical courses in freelancing, business, coding, digital marketing, and financial management. Structured programs make skill building accessible and flexible for busy professionals.

When selecting courses, prioritize options that:

- Increase earning potential

- Solve real world problems

- Provide practical certifications

Learning with intention transforms opportunities into income growth. Stronger skills support long term financial stability beyond basic budgeting and expense control.

Habit 7: Delay Gratification and Control Lifestyle Inflation

The Lifestyle Inflation Trap

As income grows, spending often rises at the same pace. Many people reward themselves with upgrades that slowly become permanent expenses. Without awareness, higher earnings fail to improve savings. Strong Financial Discipline Habits help prevent income growth from turning into uncontrolled lifestyle expansion.

Common lifestyle inflation examples include:

- Buying the latest phone

- Choosing branded clothing

- Dining out frequently

- Hosting expensive celebrations

For OFWs, vacations at home can trigger higher spending to show success. While rewarding yourself is natural, unchecked upgrades reduce long term financial progress.

Financial stability requires balance. Increased income should first strengthen savings and investments before expanding lifestyle costs.

Practice Intentional Upgrading

Improving your lifestyle is not wrong. The key is intentional decision making. Financial Discipline Habits encourage thoughtful upgrades that align with long term goals rather than emotional impulses.

Before making a major purchase, ask:

- Does this support my goals

- Will this add lasting value

- Is this need or validation

Pausing before spending builds awareness and control. Saying no to unnecessary upgrades protects savings and accelerates financial growth.

Intentional choices allow you to enjoy progress without sacrificing stability. Discipline ensures that income increases translate into wealth building instead of higher expenses.

Habit 8: Separate Emotional Decisions From Financial Decisions

Avoid Guilt Driven Spending

Many OFWs feel guilt for being far from their families. This emotion can lead to excessive remittances or unnecessary gifts. While generosity is admirable, Financial Discipline Habits require balance. Supporting loved ones should not compromise long term stability.

Healthy financial discussions should include:

- Clear monthly support limits

- Shared family goals

- Structured household budgeting

Open communication prevents misunderstandings and unrealistic expectations.

Emotional spending may provide temporary comfort but often weakens savings and investment progress. Discipline ensures that financial help remains sustainable and aligned with long term plans.

Pause Before Major Purchases

Strong Financial Discipline Habits include creating space between emotion and action. Impulsive purchases often happen when decisions are rushed. A simple delay strategy helps improve clarity.

Apply a 48 hour rule for non essential purchases. After two days, reassess whether the item is truly necessary and aligned with your goals.

During this pause, consider:

- Long term financial impact

- Current savings progress

- Real need versus impulse

Delaying decisions reduces regret and strengthens financial control. Thoughtful spending protects stability and reinforces disciplined habits over time.aligned with your goals, proceed. If not, save the money. Small pauses create powerful discipline.

Habit 9: Review Finances Monthly

Conduct a Personal Financial Audit

Consistent Financial Discipline Habits require regular review. A monthly financial audit helps you measure progress and correct problems early. Without evaluation, overspending and missed targets continue unnoticed. Reviewing your finances strengthens accountability and keeps long term goals on track.

Each month, examine:

- Total income received

- All recorded expenses

- Current savings rate

- Debt reduction progress

- Investment performance

This review highlights patterns and reveals whether your actions align with your financial plan.

Tracking numbers may feel uncomfortable at times, yet clarity builds confidence. Honest assessment prevents small issues from becoming serious financial setbacks.

Adjust Strategies When Necessary

A monthly review should lead to action. If expenses increased unexpectedly, identify the cause and apply immediate corrections. Small adjustments made early protect long term financial stability.

When reviewing results, consider:

- Why spending increased

- Where costs can be reduced

- How savings can improve

If savings grew or debt decreased, acknowledge your progress and gradually raise targets. Celebrating responsible decisions reinforces discipline.

Financial Discipline Habits rely on consistent evaluation and thoughtful adjustments. Regular review transforms financial management from guesswork into intentional planning.

Habit 10: Plan for Retirement Early

Do Not Rely Only on Active Income

Many OFWs believe they can work abroad for many years without interruption. In reality, contracts end, health conditions change, and global demand shifts. Financial Discipline Habits include preparing for a time when active income may stop.

Retirement planning should involve:

- Long term investments

- Reliable pension programs

- Business preparation before returning home

Starting early provides flexibility and reduces financial pressure later.

The earlier you build retirement funds, the smaller the monthly contribution required. Planning ahead transforms uncertainty into control and protects your future stability.

Build Assets That Generate Income

True financial stability develops when income continues even without daily labor. Relying only on active employment creates risk. Financial Discipline Habits encourage building assets that produce steady returns over time.

Income generating assets may include:

- Rental properties

- Dividend investments

- Small businesses

- Online service platforms

These assets provide additional security and reduce dependence on physical work.

When passive or semi passive income supports your needs, retirement becomes less stressful. Strategic asset building ensures long term financial independence and peace of mind.

Habit 11: Surround Yourself With Financially Responsible Influences

Your Environment Shapes Your Behavior

Your daily environment strongly influences your financial decisions. When people around you overspend or treat debt as normal, maintaining Financial Discipline Habits becomes difficult. Behavior often mirrors the standards accepted within your circle.

Negative influences may include:

- Encouraging unnecessary spending

- Treating debt as normal

- Valuing status symbols excessively

These patterns weaken long term financial focus.

Instead, seek environments that support growth and responsibility. Positive influences reinforce disciplined choices and long term thinking.

Choose to surround yourself with:

- Financially responsible friends

- Educational financial content

- Mentors focused on sustainable growth

Strong influences help strengthen consistent habits and better decision making.

Limit Negative Financial Influences Online

Social media can distort financial expectations. Many platforms highlight luxury lifestyles without showing the debt or stress behind them. Constant exposure may create pressure to spend beyond your means.

Keep these reminders in mind:

- Some luxury posts rely on debt

- Comparison reduces financial peace

- Your journey is personal

Financial Discipline Habits require mental strength and self awareness. Protecting your mindset is as important as protecting your savings. Limiting negative influences supports long term financial stability.

Habit 12: Teach Your Family Financial Discipline

Financial Stability Is a Team Effort

For OFWs, financial success depends on cooperation between the worker abroad and the family at home. Financial Discipline Habits become stronger when everyone understands shared goals and responsibilities. Clear communication reduces conflict and builds trust within the household.

Involve family members in:

- Budget planning

- Setting savings targets

- Discussing investment plans

Transparency prevents misunderstandings and unrealistic expectations. When financial decisions are shared, discipline becomes a collective effort instead of a personal burden.

Working as a team strengthens accountability. It ensures that remittances and income are used wisely and aligned with long term objectives.

Educate Children Early

Teaching children about money builds long term stability for the entire family. Early lessons create habits that last into adulthood. Financial Discipline Habits passed down to the next generation protect future financial security.

Important lessons include:

- The value of saving

- The power of delayed gratification

- The difference between needs and wants

These principles encourage responsible decision making.

Financial stability should not end with one person’s effort. When children understand discipline and planning, the entire family benefits from stronger financial foundations for years to come.

Common Mistakes That Destroy Financial Discipline

Even with strong intentions, certain behaviors can quietly weaken Financial Discipline Habits. Small repeated mistakes often cause larger financial setbacks over time. Awareness is essential because ignoring these patterns allows them to grow and disrupt long term stability.

Common mistakes include:

- Ignoring small daily expenses

- Using credit cards without a plan

- Lending money without clear boundaries

- Starting businesses without research

- Avoiding financial discussions at home

Each of these habits reduces control and increases financial risk.

Recognizing these mistakes early protects your progress. Correcting them quickly restores direction and strengthens discipline. Financial stability depends not only on good habits but also on avoiding actions that silently undermine your goals.

How Financial Discipline Habits Create Long Term Stability

Financial discipline is not about being perfect every month. It is about steady consistency over time. Strong Financial Discipline Habits turn simple actions into powerful long term results. Small responsible decisions repeated daily create lasting financial security and personal confidence.

When you consistently:

- Track expenses

- Save before spending

- Avoid unnecessary debt

- Invest in valuable skills

- Review finances monthly

You build positive momentum. These habits reinforce each other and strengthen overall financial control.

Over time, consistent discipline leads to:

- Growing emergency funds

- Reduced or eliminated debt

- Compounding investments

- Lower financial stress

- Increased confidence

Financial stability gradually becomes your normal condition rather than a distant goal.

For OFWs, this stability means:

- Returning home with security

- Funding children’s education

- Building a home responsibly

- Retiring with dignity

Disciplined habits transform hard earned income into lasting protection and peace of mind.

Final Thoughts on Financial Discipline Habits

Financial stability does not happen in a single moment. It develops through daily decisions repeated over time. Strong Financial Discipline Habits turn ordinary actions into lasting results. Each responsible choice strengthens your future and protects your hard earned income.

Financial stability grows when you:

- Choose savings over impulse

- Track spending instead of guessing

- Invest in skills over temporary pleasure

- Focus on long term goals

These small decisions create steady progress.

The most financially successful individuals are not always the highest earners. They are the most disciplined and consistent. Income matters, yet behavior determines long term results.

Start with small improvements. Remain consistent even when progress feels slow. Stay patient during setbacks.

For OFWs, every sacrifice carries deep meaning. Practicing Financial Discipline Habits transforms effort into security. Lasting stability becomes one of the greatest gifts you can offer yourself and your family.

Continue exploring by visiting the section below.

- Productivity Habits for Filipinos Working Overseas

- Tips to Stay Motivated When Working from Home

- Emergency Fund Planning for Families With OFWs

- Financial Checklists Filipinos Should Complete Before Returning Home

- Income Diversification Ideas That Do Not Require Big Capital

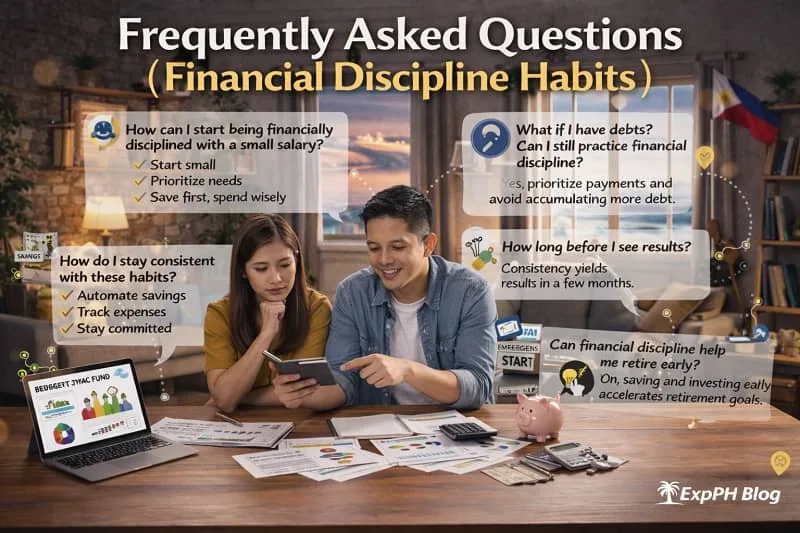

Frequently Asked Questions

What are discipline-building habits in personal finance?

Discipline-building habits are consistent money behaviors like budgeting, saving regularly, avoiding impulse spending, and tracking expenses. These habits create structure, control, and long term financial stability.

Why are Financial Discipline Habits important for OFWs?

Financial Discipline Habits help OFWs manage remittances, avoid unnecessary debt, build savings faster, and secure their family’s future despite distance, income pressure, and lifestyle temptations.

How can I start building financial discipline?

Start by tracking expenses daily, setting clear financial goals, creating a simple budget, and saving before spending. Small consistent actions build strong financial discipline over time.

How much should I save each month?

A common rule is saving at least 20 percent of income. However, adjust based on responsibilities, debt levels, and goals. The key is consistent saving.

Can Financial Discipline Habits help eliminate debt?

Yes. Consistent budgeting, prioritizing high interest payments, and avoiding new unnecessary loans can gradually eliminate debt and restore financial stability and peace of mind.

What is the biggest mistake that weakens financial discipline?

Impulse spending and lack of tracking are common mistakes. Without awareness and control, money disappears quickly, making it difficult to build savings and long term stability.

How does tracking expenses improve financial stability?

Tracking expenses increases awareness of spending patterns. It reveals unnecessary costs, encourages smarter decisions, and helps align daily spending with long term financial goals.

Should I build an emergency fund before investing?

Yes. An emergency fund protects you from unexpected expenses, preventing debt. Once savings cover three to six months of expenses, investing becomes safer.

How can I avoid lifestyle inflation?

Maintain a stable lifestyle even after income increases. Prioritize savings and investments first, then upgrade gradually while staying aligned with long term financial goals.

How long does it take to see results from Financial Discipline Habits?

Results vary, but consistent habits show improvements within months. Reduced debt, growing savings, and improved confidence are early signs of strengthening financial stability.

Learning Hub Quiz!

Think you understand the core principles behind Discipline-Building Habits That Improve Financial Stability? Test your knowledge below.

Results

#1. What is the foundation of financial discipline?

#2. What should you prioritize when salary arrives?

#3. What is the purpose of an emergency fund?

#4. How many months of expenses are ideal for emergency savings?

#5. What habit helps control overspending?

#6. What weakens financial stability most?

#7. Why is upskilling important financially?

#8. What reduces debt faster?

#9. What causes lifestyle inflation?

#10. What strengthens long term stability?

Thank you for taking the quiz.

Share your score and comment your experience with us. We would love to hear how you did and what lessons stood out most.

A Filipino web developer with a background in Computer Engineering. Founder of ExpPH Blog and PH Business Hub, creating practical content on OFW guidance, business, finance, freelancing, travel, and lifestyle. Passionate about helping Filipinos grow, he shares insights that educate, empower, and inspire readers nationwide.